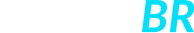

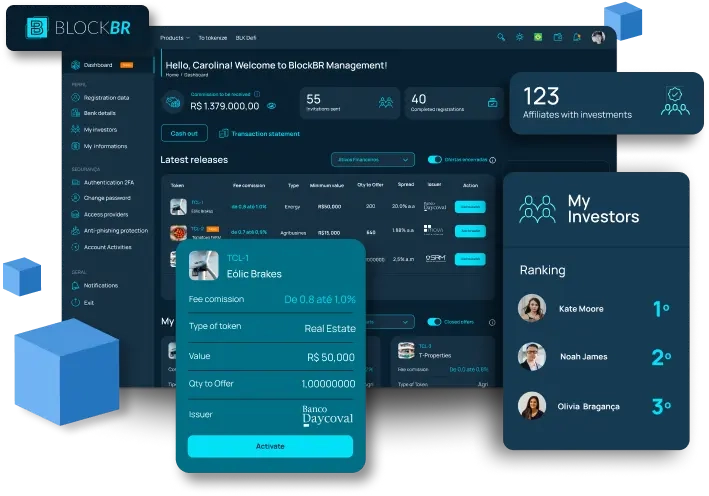

Management and distribution for Dealmakers in the tokenized market

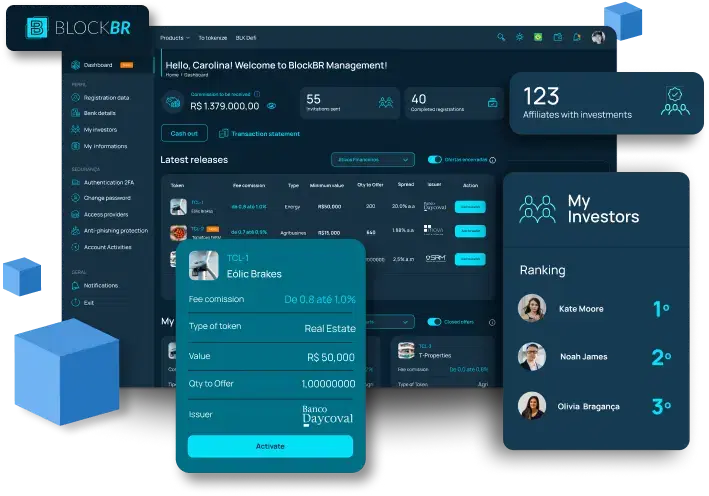

For operational autonomy, regulatory control and total efficiency, the BlockBR Management dashboard offers a complete solution for those who want to manage assets and investors with security and scalability. Ideal for Dealmakers who seek to act independently or connected to an office, with total visibility over portfolios, commissions, performance and distribution of digital assets.

Direct management, absolute compliance and real scalability for assets and investors in a 100% tokenized ecosystem

Control for dealmakers and investors to manage portfolios more efficiently, with security and autonomy, integrating regulatory compliance, debureaucratization and transparent tokenization via blockchain technology.

Fewer intermediaries, Higher Earnings

Remove barriers and securely integrate directly with asset originators and be open to performance efficiency and a new revenue stream.

- Asset indication management.

- Commission control by asset type.

- Investor ranking.

- Acquisition of new investors.

- Portfolio management.

- Performance report.

- Risk management with asset score.

- Wallet commission.

- Assets with security and guarantee of regulated fiduciary agents.

An important role in the financial education of investors

Digital transformation has reinvented the traditional role, placing it at the forefront of tokenization. This evolution maintains the essence of past commitment, now transposed into the digital landscape, where tokenization pioneers are leading the way. These professionals are embracing new technologies to offer more agile, secure, and personalized services, reflecting the constant innovation and emerging trends of the digital financial market.

Introduction to digital currencies

The increasing adoption of stablecoins by various countries highlights the growing prominence of digital currencies. The future of fiat currency lies in blockchain, and financial instruments must adapt to interact with this digital ecosystem.

Financial education

Guiding, advising, and assisting investors in financial planning and decision-making, with the aim of helping them achieve their investment goals efficiently and safely, will become simpler and more efficient over time.

Accelerating adoption

The rise of tokenized assets is driven by their superior technology, offering unparalleled convenience, broad access, and high liquidity. Clients will increasingly prefer tokenized assets to traditional options due to the seamless user experience, ease of access, and ability to trade assets quickly.

With technology, you can go further...

Financial assets

Tokenizing assets from brokers, managers, and traditional funds allows fractional ownership, expanding market access for smaller investors.

Real assets

Digitizing real estate and token issuance allows fractional ownership, democratizing access to real estate for investors with smaller capital.

Corporate shares

Tokenizing venture capital changes startup financing, allowing fractional ownership and liquidity in illiquid markets.

Security and risk

Digitizing these assets simplifies the involved agents from operations to end-to-end management and responsibilities, facilitating secure structuring and distribution.

Liquidity and efficiency

Automate compliance, streamline operations, and offer fractional ownership to generate more gains quickly and manageably.

Maximize efficiency in the distribution of good investment assets

When excellent asset originators and market agents experience tokenization as a new way to access opportunities, change happens, and the market starts to migrate to the new. Be ahead, fill out the form with your information and talk to our team of specialists.

Content that might interest you

FREE E-BOOK: Future Investment Advisors: Tokenization and Profit Opportunities!

Few sectors of the economy offer such an exciting routine – for success and failure – as the investment market, especially in Brazil, with its tradition of creating economic crises and leaving workers and companies in constant tension.Tokenization in investments is the path for more people, with different amounts of money in their pockets, to have real and attractive earnings with the diversity of financial assets that are currently out of reach.In this e-book, we will talk about scenarios, market trends, and the possibilities with tokens that the modern investment consultant needs to know to grow further.